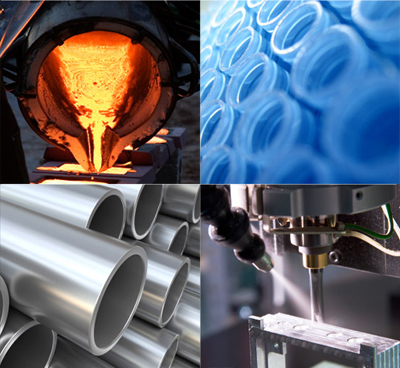

SR&ED: Chemicals, Plastics, and Metals Innovation

Companies operating in the chemicals, plastics, and metals industries invest heavily in research and development to improve material performance, process efficiency, sustainability, and regulatory compliance. These innovation initiatives often involve complex chemical, metallurgical, and materials science challenges, as well as significant technical uncertainty. The Scientific Research and Experimental Development (SR&ED) tax credit program is designed to support precisely this type of industrial and scientific advancement.

Eligibility: From Formulations to Industrial Scale-Up

Organizations may qualify for federal and provincial SR&ED tax credits when undertaking R&D aimed at achieving technological advancement in areas such as:

- Chemical formulation, synthesis, and process optimization

- Polymer development, compounding, and performance enhancement

- Recycling, waste reduction, and circular economy initiatives

- Metallurgical process development and alloy innovation

- Heat treatment, coating, and surface engineering improvements

- Process scale-up from laboratory to pilot or full production

- Quality, yield, and efficiency improvements under demanding operating conditions

Eligibility often applies even when R&D is incremental, iterative, or embedded within routine production activities, provided technological uncertainty exists and systematic experimentation is performed.

Expertise in Materials Science and Process Engineering

Pro Gestion specializes in SR&ED tax credit consulting for chemical manufacturers, plastics processors, and metals producers. Our multidisciplinary team combines scientific and engineering expertise, financial analysis, and in-depth knowledge of CRA compliance requirements to prepare accurate, defensible, and optimized SR&ED claims.

We work closely with your R&D, engineering, operations, and finance teams to:

- Identify qualifying SR&ED activities across material development and process improvement initiatives

- Capture eligible labour, materials, subcontractor, and overhead costs

- Translate complex chemical and metallurgical work into clear, defensible SR&ED technical narratives

- Strengthen claims to withstand CRA review and audit scrutiny

- Maximize SR&ED tax credit recovery while minimizing compliance risk

Securing Claims within Routine Production Cycles

Our disciplined approach ensures your R&D investments generate measurable financial returns, supporting cash flow, reinvestment, and long-term innovation. Given the continuous nature of chemical, plastics, and metals R&D, Pro Gestion acts as a long-term SR&ED partner, helping you integrate SR&ED best practices into your development, testing, and documentation processes.

Strategic SR&ED Assessment for Industrial R&D

Discover how much your chemicals, plastics, or metals R&D may be worth. Contact Pro Gestion today for a free, no-obligation SR&ED eligibility assessment and learn how our proven SR&ED tax credit services can help you maximize incentives, ensure CRA compliance, and retain critical capital to support industrial innovation.

Optimize your SR&ED tax credits today

Call Us: (877) 433-7183 ext. 223 (Toll-free across Canada)

Email Us: info@pro-gestion.com